President Trump just signed an executive order that could change retirement investing for 90 million Americans. Federal agencies now have marching orders to remove regulatory barriers that prevent 401(k) participants from accessing the same investments—private equity, real estate, and cryptocurrencies—that wealthy investors and government pension funds have used for decades to beat the market.

Here’s what’s happening, why it matters, and what American workers need to know about this shift in retirement policy.

The Current Investment Apartheid

Right now, there’s a two-tiered investment system in America. Wealthy individuals and institutional investors routinely access private equity, real estate investments, and other “alternative assets” that have historically delivered higher returns than traditional stocks and bonds.

Meanwhile, more than 90 million Americans in employer-sponsored retirement plans are stuck with a menu of mutual funds, ETFs, and basic bond options.

But it’s no accident. Like most bad ideas, this is due to government regulation. Under the Employee Retirement Income Security Act (ERISA), plan fiduciaries have faced serious legal and regulatory barriers when considering alternative investments. The Biden administration made this worse by issuing guidance that discouraged plan administrators from offering these options, citing complexity and risk concerns.

The result? Government pension funds and university endowments invest heavily in private markets and consistently outperform typical 401(k) plans, while ordinary workers are locked out of the same opportunities.

What Trump’s Executive Order Actually Does

The executive order Trump signed doesn’t change anything immediately, but it cranks up the regulatory machinery. Here’s the timeline:

Department of Labor (180 days): Must reexamine all current guidance about fiduciary duties regarding alternative investments in retirement plans. This includes clarifying what counts as prudent investment management when alternative assets are involved.

Securities and Exchange Commission: Has orders to revise regulations and guidance to help retirement plans access alternative assets.

Cross-Agency Coordination: Treasury, SEC, and other regulators must figure out what parallel changes are needed to make this work.

During Trump’s first term, his administration issued guidance in 2020 saying private equity could be part of target-date funds. The Biden administration essentially reversed this by issuing cautionary guidance in 2021 that discouraged the practice.

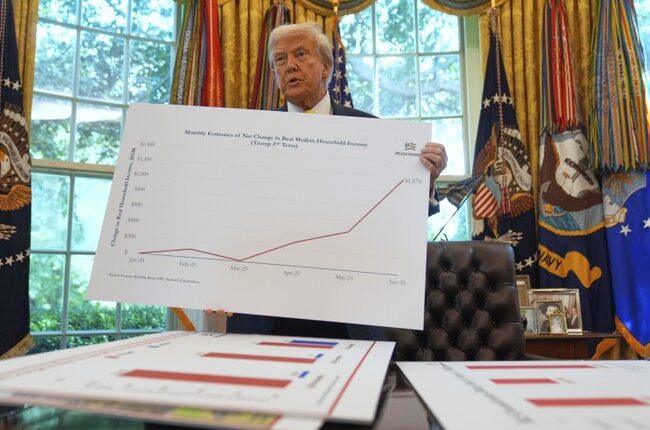

The Investment Performance Gap Is Real

The numbers tell a story about why this matters. According to data from multiple sources:

Private Equity Performance: Private equity has beaten the S&P 500 by at least 300 basis points annually over 10-, 15-, 20-, and 25-year periods, even after accounting for higher fees.

Institutional Advantage: Public and corporate pensions globally put 23 percent of their portfolios in private markets, contributing to historically higher returns compared to typical 401(k) plans.

Historical Track Record: Data from Cambridge Associates shows private equity funds delivered an average annual return of 13.1 percent over 25 years, compared to 8.6 percent for the S&P 500 during the same period.

BlackRock CEO Larry Fink has argued that the future of retirement investing should move from the traditional 60 percent stocks/40 percent bonds model to a 50/30/20 allocation that includes private assets. As Fink noted, this difference in investment options is “one reason why pensions typically outperform 401(k)s by about 0.5% each year.”

Half a percentage point might not sound like much, but compounded over a 30-year career, it represents tens of thousands of dollars in additional retirement wealth for the average worker.

Understanding the Fee Structure Reality

Critics point to the higher fees with alternative investments, and they’re right about the costs. The standard private equity fee structure is “2 and 20″—a 2 percent annual management fee plus 20 percent of profits above a minimum return threshold.

Compare this to the average mutual fund fee of 1.01% annually or ETF fees averaging 0.51 percent. But the fee analysis needs context.

Private equity managers must typically achieve at least an 8 percent annual return before collecting any performance fees. And multiple studies show that even after accounting for these higher fees, private markets have consistently beaten public markets over long periods.

The Real-World Implementation Challenges

Despite regulatory approval, expect a slow rollout. Industry experts predict 36 to 60 months before these options gain real traction in 401(k) plans.

Plan Administrator Caution: Fiduciaries are incredibly deliberate about adding complex investments. They’ll need time to develop expertise, create oversight procedures, and make sure they comply with fiduciary duty requirements.

Education Requirements: Adding alternative investments requires massive participant education efforts. Workers need to understand liquidity constraints, fee structures, and risk profiles of investments that operate differently from traditional options.

Technology Infrastructure: Most 401(k) platforms aren’t equipped to handle the valuation, reporting, and administrative requirements of private investments.

Some major providers are already positioning for this change. Empower plans to offer private equity, credit, and real estate in retirement portfolios later this year, while other firms are developing target-date funds that include alternative asset components.

The Risk-Return Equation Workers Must Understand

Alternative investments aren’t just “better” investments. They’re different investments with different risk profiles that participants need to understand.

Liquidity Constraints: Unlike stocks or bonds that can be sold daily, private equity investments can tie up capital for seven years or more. This creates problems for 401(k) loans, hardship withdrawals, and portfolio rebalancing.

Valuation Transparency: Private assets aren’t priced daily and can be difficult for participants to monitor. This makes it harder to understand performance and true investment value at any given time.

Complexity Risk: Private investments often involve sophisticated strategies that require serious due diligence. Plan fiduciaries of smaller plans may lack the expertise needed for proper evaluation and ongoing monitoring.

One financial advisor captured the concern bluntly: “You’re only asking for trouble” if participants don’t understand what they’re investing in.

The Political and Economic Implications

This executive order represents more than investment policy—it’s a statement about economic access and market fairness. The order frames the issue as ensuring “dignified and comfortable retirement for all Americans” by expanding access to assets previously reserved for the wealthy.

The private equity industry views this as a huge opportunity. The executive order opens up trillions of dollars in potential new investment, representing what industry observers call “the holy grail for private equity.”

But consumer advocates like Senator Elizabeth Warren remain skeptical about exposing retirement savers to the complexities and risks of private markets. The tension reflects broader debates about financial regulation, market access, and worker protection.

What This Means for American Workers

The question isn’t whether alternative investments can generate better returns—the historical evidence suggests they often do. The question is whether typical 401(k) participants can access these investments in a way that maximizes benefits while managing additional risks.

For the 90 million Americans currently limited to traditional 401(k) options, this executive order potentially represents the biggest expansion of retirement investment opportunities in decades. Whether it translates into better retirement outcomes depends on how thoughtfully the policy is implemented and how well workers are educated about both the opportunities and risks involved.

The investment apartheid that has kept working families from accessing Wall Street’s best opportunities may finally be ending. The challenge now is making sure that broader access leads to better outcomes, not just more ways to lose money.