What is Ron Fowler’s net worth?

Ron Fowler is an American businessman who has a net worth of $500 million. Ron Fowler is best known for his role in reshaping the ownership and financial trajectory of the San Diego Padres during the 2010s. A longtime beverage-industry executive, Fowler emerged as a major figure in professional sports ownership after becoming the Padres’ control person and executive chairman following the team’s $800 million sale in 2012. Under his leadership, the franchise transitioned from chronic instability to aggressive long-term investment, culminating in a series of record-setting player contracts that fundamentally changed the Padres’ competitive profile and national perception.

Beyond baseball, Fowler has maintained a diversified portfolio of sports and civic involvement, ranging from indoor soccer ownership to major roles in stadium development and marquee sporting events. In the mid-2020s, he expanded his footprint into English football, positioning himself as a controlling shareholder and chairman-in-waiting at Lincoln City. Across these ventures, Fowler has been defined less by day-to-day management and more by capital allocation, governance, and long-horizon institutional building, traits shaped by decades at the helm of a large privately held distribution business.

Early Life and Education

Ron Lee Fowler was born on July 23, 1944, in Minneapolis, Minnesota. He was raised in a Catholic household and attended St. Cloud Cathedral High School, where he played baseball. His father served in the U.S. Navy during World War II, an experience that influenced Fowler’s disciplined, service-oriented outlook.

Fowler earned a Bachelor of Business Administration degree from the University of St. Thomas in 1966. He later completed an MBA at the University of Minnesota. His academic background in business and finance laid the foundation for a career focused on operations, distribution, and large-scale capital management rather than entrepreneurship driven by a single brand or product.

Liquid Investments and the Beverage Business

Fowler is the chairman and CEO of Liquid Investments, Inc., a privately held investment and operating company that historically controlled beverage distribution businesses across California and Colorado. Through its operating entities, Liquid Investments distributed major beer brands including Miller, Coors, and Heineken, among others. At its peak, the group generated annual revenues exceeding $300 million.

The beverage distribution industry is capital-intensive and margin-sensitive, rewarding scale, logistics expertise, and long-term supplier relationships. Fowler’s success in this environment shaped his later approach to sports ownership, emphasizing infrastructure, media rights, and financial durability over short-term performance swings.

San Diego Padres Ownership

Fowler first became involved with the San Diego Padres as part of a minority ownership group that held just under 50% of the franchise. In 2012, after a proposed purchase led by Jeff Moorad collapsed, Fowler stepped in as general partner of the minority group and joined a new ownership consortium that included members of the O’Malley and Seidler families. Major League Baseball approved the group’s $800 million acquisition of the Padres in August 2012.

Fowler was named executive chairman and designated control person, making him the primary representative of the franchise at league meetings. The sale included the team’s 20% stake in Fox Sports San Diego, part of a long-term regional sports network deal that significantly stabilized the club’s finances.

During Fowler’s tenure, the Padres broke from their historically conservative spending patterns. The team signed Wil Myers, Eric Hosmer, and Manny Machado to successive franchise-record contracts, culminating in Machado’s 10-year, $300 million deal in 2019. These moves signaled a strategic shift toward sustained competitiveness and elevated the Padres’ standing within MLB ownership circles.

In November 2020, MLB approved Fowler’s transfer of the chairman role to Peter Seidler, who increased his ownership stake. Fowler remained vice chairman until stepping away from the organization in 2022.

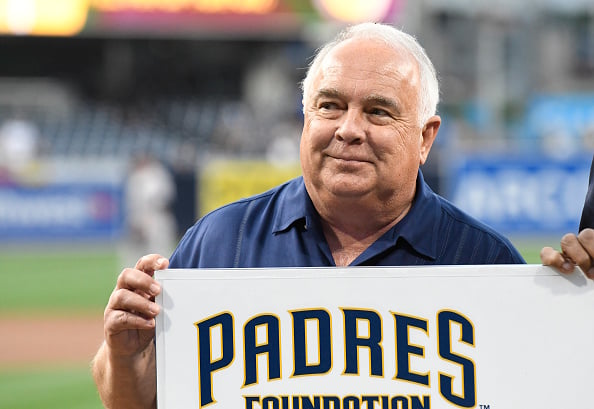

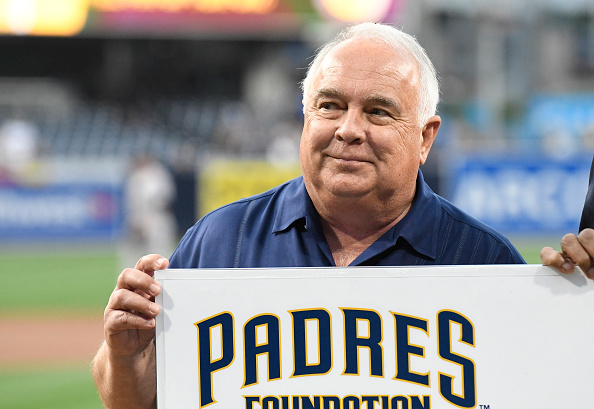

Getty

Lincoln City Investment

In April 2024, Fowler and his son Andrew acquired a minority stake in Lincoln City, a League One football club in England, through Liquid Investments. The initial investment represented approximately 12.6% of the club’s holding company.

By December 2025, Lincoln’s board approved a proposal allowing Liquid Investments to increase its stake above 25%, a threshold recognized by the English Football League as conferring control. Subject to league approval, the move positions Fowler as controlling shareholder and chairman, with responsibility for funding the club and supporting infrastructure projects at LNER Stadium. The investment reflects Fowler’s broader interest in sports institutions with strong local identity and long-term growth potential rather than global brand dominance.

Other Sports and Civic Roles

Fowler previously owned the San Diego Sockers, an indoor soccer franchise that won 10 championships in 11 seasons, establishing one of the most dominant runs in the sport’s history. He also chaired San Diego’s original task force responsible for selecting the site that became Petco Park and led the host committee for Super Bowl XXXVII, held in 2003. These roles placed him at the intersection of sports, urban development, and civic planning.

Philanthropy

Ron Fowler and his wife Alexis are prominent philanthropists, particularly in higher education. In 2016, San Diego State University renamed its College of Business the Fowler College of Business following a $25 million donation from the couple. An earlier challenge gift helped fund the Fowler Athletic Center.

The Fowler family has also made eight-figure donations to the University of St. Thomas and the University of San Diego, supporting both academic initiatives and athletic programs. Their giving reflects a focus on institutional capacity building rather than one-time charitable contributions, mirroring Fowler’s broader business and ownership philosophy.

All net worths are calculated using data drawn from public sources. When provided, we also incorporate private tips and feedback received from the celebrities or their representatives. While we work diligently to ensure that our numbers are as accurate as possible, unless otherwise indicated they are only estimates. We welcome all corrections and feedback using the button below.