On Thursday, Nvidia’s stock took an epic jump among the nation’s corporate giants. In one day, the graphics-chip maker total market capitalization added nearly $184 billion – that’s billion with a b. It is one of the biggest one-day market capitalization gains in American corporate history.

Nvidia’s market capitalization was $754.3 billion at the stock market’s close on Wednesday, according to Dow Jones Market Data, and it traded as high as $973.8 billion intraday on Thursday, closing around $938.1 billion, based on 2.47 billion shares outstanding and shares at $379.80.

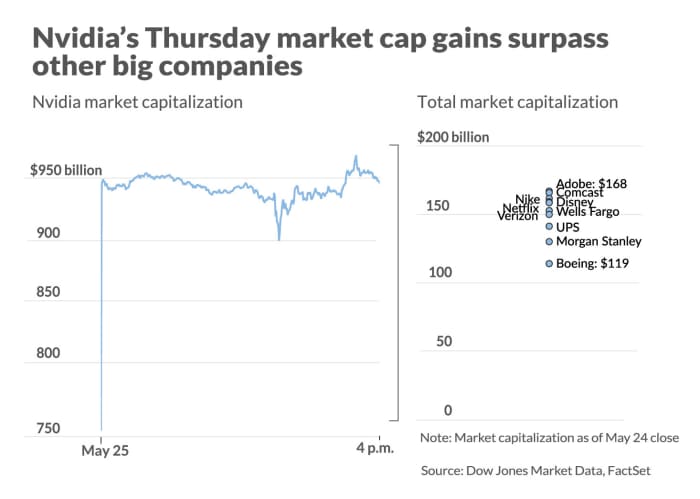

To get a sense of the scale, Nvidia’s market capitalization gain on just Thursday was greater than the entire stock market capitalization of some of the biggest and most iconic companies, which operate in industries ranging from banking, entertainment, apparel and software.

Below is a comparison of 10 S&P 500 companies with total market capitalizations that are less than the gain Nvidia has experienced on Thursday.

MARKETWATCH

Ever heard of Wells Fargo

WFC,

Morgan Stanley

MS,

Blackstone Group

BX,

or Goldman Sachs

GS,

? These are the titan companies of Wall Street. Nvidia’s market cap increase on Thursday was bigger than the whole market capitalization of each of these companies.

Bigger than Mickey Mouse? Yes. Nvidia’s market capitalization jump on Thursday was bigger than the entire market capitalization of Walt Disney Co.

DIS,

Netflix

NFLX,

Nike

NKE,

Boeing, UPS

UPS,

Verizon

VZ,

and Adobe

ADBE,

If Nvidia’s market capitalization gain on Thursday was its own company, it would be the 55th biggest public company on Earth, according to data from companiesmarketcap.com.

Of course, Nvidia

NVDA,

is one company and its total market cap is now approaching $1 trillion. There are only five companies in the world that sport market capitalizations in excess of $1 trillion — Apple

AAPL,

Microsoft

MSFT,

Saudi Aramco, Alphabet (Google)

GOOGL,

and Amazon

AMZN,

Nvidia will join the club if it ever closes at $404.86. The stock closed at $379.80 on Thursday.

What happened on Thursday? Nvidia CEO Jensen Huang and the company’s other executives said Wednesday evening that AI-driven data-center sales would power record revenue that would reach some $11 billion in the second quarter, compared to the $7.17 billion Wall Street analysts were expecting, according to FactSet. Last year, Nvidia reported $6.7 billion in revenue in the second quarter.

Dan Ives, the Wedbush Securities tech analyst, tweeted that “in 22 years of covering tech stocks and large cap we have NEVER seen a guidance range of this magnitude on a large cap tech name.”

It is a game changer in many ways. According to a MarketWatch analysis of FactSet data, Nvidia now represents about 4.6% of the entire Nasdaq stock market, compared to 3.74% yesterday.

– With reporting from Philip van Doorn