Before sitting down to write this article, I took a few minutes to think about the most significant cultural moments of my childhood. I was born in the early 1980s, so while the fall of the Berlin Wall would make almost anyone’s list, my memory of it is hazy at best.

When I talk about “significant cultural moments,” I don’t mean headlines. I mean the events that stopped the gears of normal life—the kind where every single TV channel carried the same live feed, normal programming simply evaporated, and it felt like the entire world was holding its collective breath in front of a glowing screen.

For me, the five defining cultural “blackouts” of the ’90s and early 2000s were:

- The O.J. Simpson car chase in 1994

- The O.J. verdict in 1995

- The death of Princess Diana in 1997

- The death of JFK Jr. in 1999

- The September 11th attacks

Out of the five moments I’ve chosen, I’m sure some younger readers are scratching their heads at #4. Was the death of John F. Kennedy Jr. really that big of significant a cultural moment?

Absolutely.

The entire Western world stood still for days as that awful tragedy unfolded.

For those of you who are not aware, on July 16, 1999, a small plane piloted by JFK Jr (the son of President John F. Kennedy and Jacqueline Onassis) disappeared off the coast of Martha’s Vineyard. For days, coverage was wall-to-wall as search crews scoured the Atlantic. Considering his family’s tragic history, it felt surreal and almost too much to bear. We held our collective breath, praying that it was all a silly mix-up or that they were miraculously rescued by a fisherman. When it was confirmed that John, his wife Carolyn Bessette, and her sister Lauren had died in the crash, it felt like a nightmare coming true and the closing chapter of a uniquely American dynasty.

The lives of JFK Jr. and Carolyn Bessette are back in the spotlight with the release of Ryan Murphy’s latest 1990s nostalgia drama, “Love Story: John F. Kennedy Jr. and Carolyn Bessette.” I’ve watched the first two episodes, and like many people, it sent me back down the JFK Jr. rabbit hole. And for me, the owner/operator of CelebrityNetWorth.com, the primary rabbit hole I’ve been down involves JFK Jr.’s finances.

John wasn’t just a President’s son or a tabloid fixture. He was the heir to one of the most sophisticated wealth-preservation engines in history.

So how much was JFK Jr. worth? And who ultimately inherited the money?

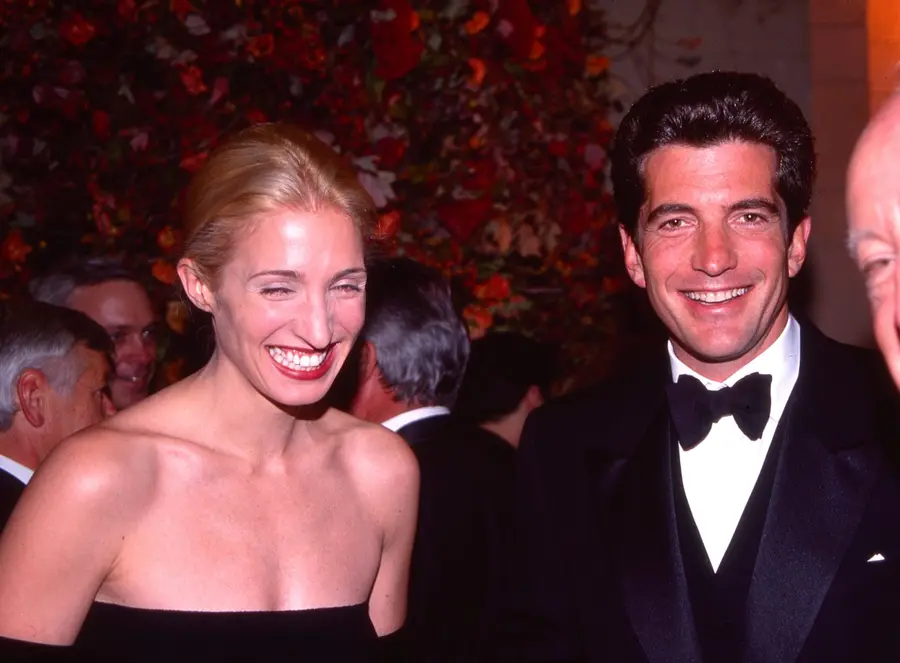

Carolyn Bessette-Kennedy and John F Kennedy Jr, October 4, 1998. (Photo by Sonia Moskowitz/Getty Images)

The Hidden Kennedy Family Fortune

When John F. Kennedy Jr.’s will was filed in Manhattan Surrogate’s Court shortly after his death, the headline numbers looked surprisingly small. The document used standard jurisdictional language stating that his estate was worth “more than $1 million.”

However, probate only captures assets titled directly in a person’s name at the time of death. It does not include wealth held inside private trusts, which operate outside of court supervision and remain largely shielded from public disclosure.

And when it comes to private trusts, nobody does it like the Kennedys.

The Kennedy family fortune originated with JFK Jr.’s grandfather, Joseph P. Kennedy Sr.

Contrary to popular urban legend, Joe Kennedy did not build his fortune as a bootlegger during Prohibition.

After graduating from Harvard in 1912, Kennedy went to work for Columbia Trust Bank. When the bank encountered financial trouble, he borrowed $45,000 from friends and family to buy a controlling interest. From there, he moved to Wall Street, where he proved himself a shrewd and disciplined investor.

Kennedy made his first millions during the roaring 1920s bull market. Crucially, he also knew when to get out. In 1929, sensing speculative mania, he shifted heavily into short positions before the crash. He later claimed he realized the market had peaked when even his shoe-shine boy was offering stock tips. Whether apocryphal or not, the story captures the essence of Kennedy’s financial instinct: he understood cycles, psychology, and timing.

During the Great Depression, while others were liquidating assets at fire-sale prices, Kennedy went shopping. He acquired large amounts of real estate at deeply discounted values. Over time, these holdings appreciated dramatically and became a core pillar of the family’s wealth.

For decades, one of the crown jewels of the Kennedy portfolio was Chicago’s Merchandise Mart, which Joe purchased in 1945 for just under $13 million. At the time, it was considered an unwieldy white elephant. Under Kennedy’s ownership, it became a steady cash-flow machine. In 1998, the Kennedy family sold the Merchandise Mart to Vornado Realty Trust for $625 million.

By the late 1940s, Joe Kennedy shifted from wealth accumulation to wealth preservation. He began constructing a sophisticated trust system designed to protect principal, minimize estate taxes, and provide structured income to future generations. Trusts were established in 1926, 1936, and 1949, with later vehicles benefiting grandchildren, including John F. Kennedy Jr.

The philosophy was simple: the capital would remain controlled and largely untouchable, while heirs would receive income distributions. The Kennedys would be wealthy, but rarely in direct possession of the full principal.

By the time Joe Kennedy died in 1969, informed estimates placed the family fortune at around $400 million. Adjusted for inflation, that would be several billion dollars today.

JFK Jr’s Estate

JFK Jr. and his sister Caroline Kennedy were beneficiaries of trusts set up by their grandfather AND trusts set up by their father. When John F. Kennedy Sr. died in 1963, he was worth $12 million – roughly $100 million in today’s dollars. Their mother, Jackie O, was also a beneficiary of her husband’s trusts.

In the months after his death, contemporary financial reports pegged JFK Jr.’s true net worth to be between $30 million and $100 million. Adjusted for inflation, that would be roughly $60 million to $200 million today.

Who Inherited the Estate?

John and Carolyn died together and had no children. His estate plan anticipated exactly this scenario.

His will stated that if his wife, Carolyn Bessette-Kennedy, survived him, she would inherit his tangible personal property, including their Tribeca apartment and its contents. But because Carolyn and her sister Lauren died in the same crash, the estate flowed to the next tier of beneficiaries.

With no children of his own, John directed that his personal property and trust interests pass primarily to the three children of his sister, Caroline Kennedy:

- Rose Kennedy Schlossberg

- Tatiana Kennedy Schlossberg

- John B. Kennedy Schlossberg

At the time of the crash, they were 11, 9, and 6 years old. Tragically, Tatiana just died the past December at the age of 35 after a battle with leukemia. John, 33 (who goes by Jack), is currently running for Congress to represent New York’s 12th district. Rose, 37, is a Peabody Award-winning filmmaker.

In addition to the family inheritance, his 1983 trust provided bequests to a small circle of longtime family employees and close associates. Beneficiaries included his mother’s longtime personal assistant, the family cook and governess, and his assistant at “George” magazine. Two charities were also named: Reaching Up, an organization he founded to support workers assisting people with disabilities, and the John F. Kennedy Library Foundation.

The estate also included his 2,600-square-foot Tribeca penthouse, which he had purchased in 1994 for $700,000. A year after his death, the apartment sold for $2 million.

There was also his ownership stake in “George.” Following his death, his publishing partner, Hachette Filipacchi Magazines, purchased his interest for an undisclosed sum, providing additional liquidity to the estate.

The “Per Stirpes” Effect: Why the JFK Branch Is Financially Different

Joseph P. Kennedy structured much of the family fortune to flow “per stirpes,” a legal term meaning “by branch.” Think of the dynasty as a river that splits into separate streams for each of Joe’s children. Each child’s line would receive its allocated share, and that share would then be divided among that child’s descendants.

The Robert F. Kennedy branch, for example, was divided among 11 children and then further divided among dozens of grandchildren and great-grandchildren.

But the JFK branch evolved very differently.

President John F. Kennedy had only two children who survived to adulthood: Caroline and John Jr. When John Jr. died in 1999 without children, his share did not splinter into a new sub-branch. It reverted to the surviving line. That meant the entirety of President Kennedy’s trust stream effectively consolidated under Caroline Kennedy.

Jack and Rose Schlossberg are in a unique financial position. Assuming they eventually inherit their mother’s position as the sole beneficiaries of the JFK line, they will control a concentration of Kennedy wealth that is mathematically vastly superior to their peers. While an RFK great-grandchild might inherit a diluted fraction of the original trust, Jack and Rose are poised to split the entirety of a founding branch between just the two of them. This does not mean they will inherit tens of millions of dollars someday. It means they will inherit the right to the income generated by their share of the family trusts, which will presumably be a much larger share of income.

If Jack Schlossberg’s congressional campaign is successful, he will file a financial disclosure that may reveal more about the current state of the Kennedy fortune. If that happens, we’ll report back.

One Final Footnote

Because the National Transportation Safety Board (NTSB) ultimately cited “pilot error” as the cause of the crash, JFK Jr.’s estate faced significant legal liability for the deaths of Carolyn and Lauren Bessette. For eighteen months, a quiet but intense legal battle played out between Caroline Kennedy, as the executor of her brother’s estate, and Ann Freeman, Carolyn’s mother.

In July 2001, just days before the deadline to file a formal wrongful death lawsuit, the two families reached a settlement. The Kennedy estate reportedly paid the Bessette family $15 million.

While the exact figure was shielded by confidentiality agreements, legal experts at the time noted that the sum likely came from a combination of John’s personal assets and substantial liability insurance policies.