What is Trip Hawkins’s net worth and salary?

Trip Hawkins is an American business executive and company founder who has a net worth of $1.5 million. Trip Hawkins is a pioneering figure in the video game industry, best known as the founder of Electronic Arts (EA), one of the most successful video game publishers in history. Hawkins graduated from Harvard University with a self-designed major in Strategy and Applied Game Theory, then earned an MBA from Stanford. In 1978, he joined Apple as one of its first 50 employees, where he worked directly under Steve Jobs and helped shape the company’s early strategy.

In 1982, Hawkins left Apple and used $200,000 of his own money to launch Electronic Arts. His vision was to treat video games as a creative art form and elevate developers to the status of rock stars. EA quickly became a powerhouse with titles like Pinball Construction Set, Archon, and M.U.L.E., but its breakout came in 1988 with John Madden Football. Under Hawkins’ leadership, EA secured licensing deals with major sports leagues and launched blockbuster franchises like Madden NFL, FIFA, and NHL.

After EA went public in 1989. Hawkins owned 20% of the company at that point. By the mid-1990s, his net worth peaked at around $100 million. He left the company around that time to found The 3DO Company, a console manufacturer whose hardware ultimately failed against competitors like Sony’s PlayStation.

To fund 3DO and his lavish lifestyle, Hawkins sold much of his EA stock and used complex tax shelters that were later disallowed by the IRS, resulting in a $36 million tax liability. He filed for bankruptcy in 2006 but was denied a discharge of his tax debts.

Despite these setbacks, Hawkins continued working in tech and education, launching startups and serving as a professor at UC Santa Barbara. His legacy remains deeply embedded in the foundations of modern gaming.

Early Life & Education

William “Trip” Hawkins III was born on December 28, 1953. From a young age, Hawkins was fascinated by both games and technology. He graduated from Harvard University in 1976, where he designed his own major—Strategy and Applied Game Theory—and also played varsity football. He later earned an MBA from Stanford Graduate School of Business, a combination that uniquely positioned him to bridge business, creative design, and software innovation.

While at Harvard, Hawkins overlapped with future tech titans Bill Gates and Steve Ballmer, though his professional path would soon diverge into interactive entertainment, a field he would help revolutionize.

Early Career at Apple

In 1978, Hawkins became one of the first 50 employees at Apple Computer. He initially reported to Mike Markkula and eventually to Steve Jobs as Director of Strategy and Marketing. During his time at Apple, he had a formative insight: the company was full of creative software developers—”artistic weirdos,” as he later put it—being directed to build productivity software. Hawkins believed those same minds could be channeled into something more expressive and fun: video games.

Founding Electronic Arts

In May 1982, Trip Hawkins left Apple and invested $200,000 of his own money to launch a video game development company. By December, he raised his first round of venture capital and brought Apple co-founder Steve Wozniak on board as an early advisor.

Hawkins named the company Electronic Arts, and from the start he positioned game developers as rock stars. EA’s early branding featured developers’ headshots styled like album covers, a bold move in an industry where creators were rarely credited. His founding philosophy was to treat software as an art form and developers as artists.

One of EA’s first breakout hits was 1-on-1 with Dr. J & Larry Bird—the first game to license the likeness of professional athletes. Dr. J and Bird were each paid $25,000 and earned a 2.5% royalty on sales, setting a new precedent for athlete-driven gaming.

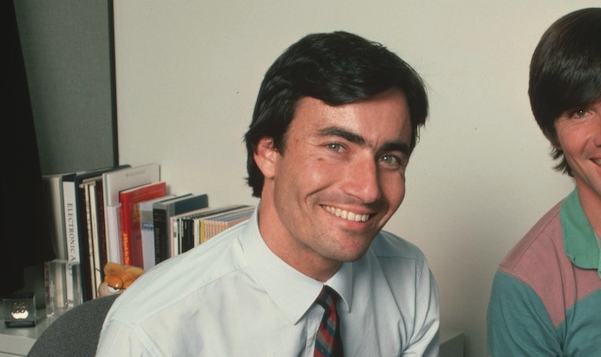

Trip Hawkins (left) and a young business associate at Electronic Arts in 1984 (Photo by © Roger Ressmeyer/CORBIS/VCG via Getty Images)

EA’s Rise and Trip’s Peak Net Worth

Throughout the 1980s and 1990s, Electronic Arts grew into one of the most powerful video game publishers in the world. The company became known for iconic PC titles like Pinball Construction Set, Archon, and M.U.L.E., but its mainstream breakthrough came in 1988 with the release of John Madden Football. That led to multi-decade licensing deals with major sports leagues, eventually creating the Madden NFL, FIFA, and NHL gaming dynasties.

EA went public on January 9, 1989, under the NASDAQ ticker ERTS, raising significant capital. At the IPO, Trip owned 20% of the company. By the mid-1990s, the company’s market cap was around $1 billion. By that point, after various sales and dilutions, Hawkins owned 10%, giving him a net worth of $100 million.

The 3DO Gamble and Tax Trouble

In the early 1990s, Hawkins stepped back from day-to-day operations at EA to launch a new venture: The 3DO Company, which aimed to revolutionize home gaming hardware. Backed by partners like Panasonic and Time Warner, 3DO released its console in 1993. However, it was priced too high and underperformed against Sony’s PlayStation. Despite investing $12 million of his own money, 3DO ultimately failed, filing for bankruptcy in 2003.

To fund both his lifestyle and his new venture, Hawkins sold $66 million worth of EA stock between 1996 and 1998. Instead of paying the resulting capital gains taxes, he followed the advice of KPMG and used aggressive offshore tax shelters known as FLIP and OPIS, involving Cayman Islands and Swiss bank transactions. These strategies created over $60 million in artificial paper losses on just $3.5 million of real investment.

In 2002, the IRS disallowed the shelters and, together with California’s Franchise Tax Board, assessed Hawkins roughly $36 million in back taxes and penalties. Though he paid down about $10 million by selling assets—including a private jet that originally cost $11.8 million—he still faced a massive unpaid balance. At one point, court records showed that Hawkins’ household was spending up to $78,000 more per month than its income.

Bankruptcy and Legal Battles

Hawkins filed for Chapter 11 bankruptcy in 2006. At first, he lost badly: both the bankruptcy court in 2010 and a federal district court in 2011 ruled that his tax debts were non-dischargeable, citing his acknowledged insolvency and continued lavish lifestyle. Judge Jeffrey White famously wrote that Hawkins had “planned to defeat his taxes via bankruptcy and continue living the lifestyle to which he had grown accustomed,” pointing to a $70,000 Escalade he bought as the family’s fourth car.

But in 2014, the Ninth Circuit Court of Appeals reversed, holding that mere overspending wasn’t enough. To block a discharge, the government had to prove Hawkins acted with specific intent to evade taxes. The case was sent back to bankruptcy court for reconsideration.

This time, Hawkins prevailed. In 2016, Judge Thomas Carlson ruled that Hawkins did not act with fraudulent intent and that he genuinely believed his KPMG-advised shelters were legitimate. The court concluded that while his spending was reckless, it wasn’t a deliberate attempt to defraud the IRS. A final judgment entered that year discharged all of Hawkins’ pre-bankruptcy federal and state tax liabilities, effectively wiping away more than $25 million in debts after a decade of litigation.

Life After EA

Hawkins has remained active in technology and gaming. In the 2010s, he served on the boards and advisory teams of several startups, including:

- Extreme Reality (3D motion tracking software)

- Nativex (mobile gaming ad tech)

- Skillz (mobile eSports platform)

He also launched a startup called If You Can Company, which built educational games to promote emotional intelligence and anti-bullying in children.

From 2016 to 2019, he taught entrepreneurship and leadership at UC Santa Barbara. As of the mid-2020s, he resides in Santa Barbara and continues to work in educational technology and early-stage advisory roles.

What Could Have Been

In 1989, Hawkins owned 20% of Electronic Arts. In September 2025, EA agreed to a record-setting $55 billion leveraged buyout, led by Saudi Arabia’s Public Investment Fund and Jared Kushner’s Affinity Partners. If Trip still owned 20%, that stake would have been worth $11 billion. If he still “just” owned 10%, that stake would be worth $5.5 billion.

All net worths are calculated using data drawn from public sources. When provided, we also incorporate private tips and feedback received from the celebrities or their representatives. While we work diligently to ensure that our numbers are as accurate as possible, unless otherwise indicated they are only estimates. We welcome all corrections and feedback using the button below.