In the world of personal finance, your net worth is the ultimate scorecard. While your annual salary tells people how much money is flowing through your hands, your net worth tells the story of how much of that money you actually kept.

Whether you are aiming for retirement, tracking your progress toward a first home, or just curious how you stack up against the average household, the richest celebrities, or the richest people in the world, understanding your net worth is the first step toward true financial mastery.

The Golden Equation

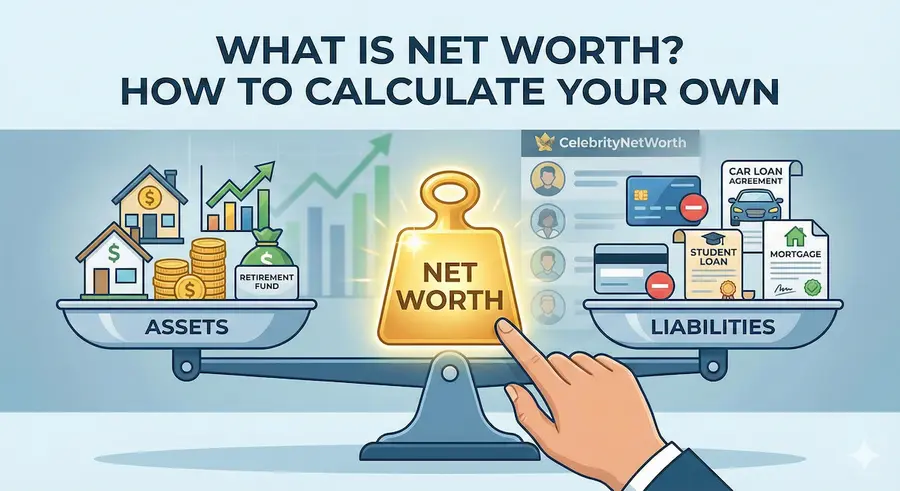

At its most fundamental level, net worth is a simple math problem:

Total Assets − Total Liabilities = Net Worth

- Assets: Everything you own that has positive monetary value.

- Liabilities: Every financial obligation or debt you owe to others.

Deep Dive: Assets vs. Liabilities

To get an accurate number, you need to categorize your financial life into two columns. Be honest—the more accurate the data, the more useful the result.

1. Common Assets (What You Own)

Assets are generally split between “liquid” (cash or things easily turned into cash) and “fixed” (physical property or long-term investments).

- Cash: Checking accounts, high-yield savings, and physical cash.

- Investments: Brokerage accounts, stock holdings, and bonds.

- Retirement Accounts: 401(k)s, IRAs, and pension values.

- Real Estate: Your primary residence, vacation homes, or rental properties.

- Personal Property: Vehicles, jewelry, fine art, and high-value collectibles.

2. Common Liabilities (What You Owe)

Liabilities are the “anchors” on your net worth. They represent claims against your assets.

- Mortgages: The remaining balance on your home or investment property loans.

- Consumer Debt: Credit card balances and personal loans.

- Education Debt: Student loans (both federal and private).

- Auto Loans: What you still owe on your vehicles.

A Real-World Example: Meet “Jane Dough”

To see how this works in practice, let’s look at Jane. On the surface, Jane lives in a $500,000 home and drives a nice car. But what is she actually worth?

| Jane’s Assets | Jane’s Liabilities |

|---|---|

| Primary Residence: $500,000 | Mortgage Balance: $200,000 |

| Stock Portfolio: $250,000 | Car Loan: $10,000 |

| Retirement Savings: $400,000 | Student Loans: $50,000 |

| Vehicle & Valuables: $25,000 | Credit Card Debt: $5,000 |

| Cash on Hand: $25,000 | |

| TOTAL ASSETS: $1,200,000 | TOTAL LIABILITIES: $265,000 |

The Final Calculation:

$1,200,000 (Assets) − $265,000 (Liabilities) = $935,000 Net Worth

Common Pitfalls: What Not to Include

When calculating your own number, it’s easy to get over-optimistic. To keep your net worth realistic, avoid these three common mistakes:

- Overvaluing Lifestyle Goods: Your 5-year-old couch and used electronics might have cost thousands, but their resale value is likely negligible. Only include items with high, verifiable resale value (like jewelry or art).

- Ignoring Taxes: If you have $1 million in a 401(k), you will eventually owe taxes on those withdrawals. Some savvy planners “discount” their retirement accounts by 15-20% to account for future taxes.

- Counting Gross Home Value: Never list your home’s value without including the mortgage in the liabilities column. You only “own” the equity, not the building.

Why Your Net Worth Matters

Tracking your net worth isn’t about bragging rights; it’s about trend lines. If your net worth is increasing every year, you are effectively “buying back” your future freedom.

Net worth is such a vital metric for understanding success and financial influence that some people decide to create entire websites, like CelebrityNetWorth, dedicated to tracking the fortunes of the world’s richest celebrities. For example:

Taylor Swift net worth

MrBeast net worth

Jay-Z and Beyoncé net worth

Elon Musk net worth

Cristiano Ronaldo net worth

Lionel Messi net worth

How Do You Compare? The State of American Wealth

According to the most recent Federal Reserve Survey of Consumer Finances, there is a massive gap between the “Average” and the “Median” American family:

- Median Net Worth: $192,900

- Average (Mean) Net Worth: $1,063,700

The Average is heavily skewed by billionaires like Elon Musk and Jeff Bezos. The Median represents the “middle” household and is a much more realistic benchmark. By comparison, our hypothetical “Jane Dough” is doing exceptionally well—her $935,000 net worth puts her in the top tier of American households.

3 Tips to Grow Your Net Worth

- Automate Your Investing: The easiest way to grow assets is to invest before you have a chance to spend. Treat your brokerage or 401(k) contribution like a mandatory bill.

- Attack High-Interest Debt: Credit card debt at 20%+ interest is a net worth killer. Paying it off is the equivalent of a “guaranteed” 20% return on your money.

- Track Annually: You don’t need to check your net worth daily (market fluctuations will drive you crazy). Check it once a year to ensure your “Assets” column is growing faster than your “Liabilities.”

The goal is simple: Grow the assets, starve the liabilities, and watch the gap between the two widen over time. How does your number compare to the American median?