Bali has long been celebrated as a tropical paradise, attracting both tourists and expats seeking a lifestyle of sun, surf culture and growing business opportunities in the rising spiritual and wellness space. In recent years, the island has also become a magnet for property investors, drawn by the promise of high returns in villas, apartments and commercial ventures. Yet beneath the idyllic facade lies a landscape of legal, financial and operational risks that can transform paradise into a costly mistake if approached without caution.

Foreign ownership of land in Indonesia is tightly restricted. Only Indonesian citizens can hold freehold titles, while foreigners are limited to leasehold arrangements — typically for 25 to 30 years with the possibility of extension. Villas and apartments are usually built on HGB (Hak Guna Bangunan) or leasehold lands, and commercial properties must often be registered through a foreign-owned PT PMA company, requiring permits via the OSS and BKPM systems.

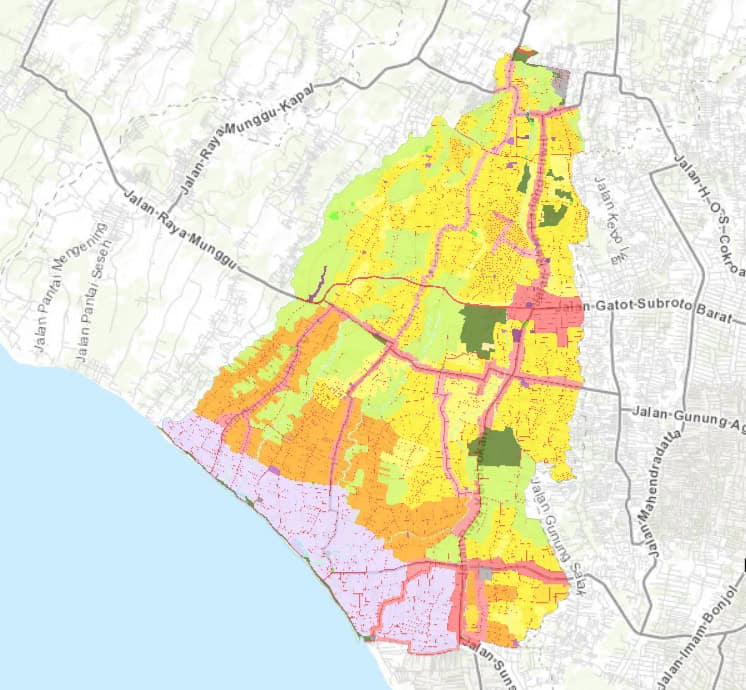

Indonesians alone can hold freehold land (Hak Milik), while foreigners are limited to rights such as Hak Pakai (right to use), Hak Sewa (leasehold) or establishing ownership via a PT PMA company, often for periods of up to 80 years. Land is also strictly zoned: yellow and orange zones are residential, red zones are commercial, pink zones cater to tourism, green zones are agricultural and conservation zones to protect natural and cultural heritage. Even in pink zones — intended for hotels and rental villas — foreign ownership is restricted to non-freehold rights, while locals can acquire freehold titles. Attempting to bypass these rules through nominee schemes — using an Indonesian citizen’s name to hold land — is illegal, fraught with risk and unenforceable under Indonesian law.

Financial risks are also mounting as Bali’s popularity drives property prices upward. Many listings reflect inflated values with little market verification, while hidden costs for permits, taxes and agent commissions can significantly reduce projected returns. Rising annual yields may look attractive on paper, but failure to factor in maintenance, occupancy rates and compliance fees can leave investors disappointed. Practical challenges — such as properties lacking proper building permits (IMB/PBG) or operational licenses (SLF) — further complicate ownership and can result in fines or even demolition.

The rapid growth of Bali’s expat community has also put pressure on local housing markets. With increasing demand for high-end villas and boutique apartments, rental rates and property costs have surged — making it harder for newcomers to find affordable accommodation. Long-term residents and investors alike must navigate a delicate balance between lifestyle aspirations and the realities of legal compliance and financial prudence.

To mitigate these risks, experts recommend thorough due diligence, including legal verification of land rights, permits and tax obligations. Contracts should be bilingual and notarised, and all dealings should be conducted with licensed agents. Opting for fully legal structures — such as Hak Pakai leases or PT PMA entities — ensures that investments are protected and extensions are contractually secured.

Beyond the legal and financial challenges, Bali’s property market raises pressing social and ethical concerns. Foreign-driven demand has pushed land and housing prices beyond the reach of many locals, fostering resentment and tensions over traditional land use. In particular, foreign-owned villas are often accused of disrupting community balance, eroding cultural norms and prioritising profit over people. Environmental impacts are also significant: deforestation, water shortages and waste issues have been linked to rapid villa and resort development.

Illegal or unregistered villas — especially in hotspots like Canggu, Uluwatu and Ubud — exacerbate these problems. Many of these properties bypass local permits, taxes and environmental regulations, offering lower rates that undercut compliant operators while depriving the government and local entrepreneurs of revenue. Journalistic investigations have highlighted how such practices give investors unfair advantages while contributing little to the local economy. The situation has also triggered nationalist backlash and concerns over corruption, with weak enforcement and bureaucratic loopholes facilitating bribery in land deals. Overall, these dynamics underscore the tension between foreign investment and the rights, culture and livelihoods of Balinese communities, highlighting the ethical and practical stakes of real estate development on the island.

Investing or living in Bali can offer tremendous lifestyle and financial rewards, but only with careful preparation and professional guidance. Understanding the island’s legal frameworks, property regulations and market dynamics is essential for anyone seeking to turn the Balinese dream into a sustainable reality rather than a cautionary tale.

For more on the latest in lifestyle, culture and travel reads, click here.