Investing is all about being in tune with the developments. Right here’s one to pay attention to for 2022: Worth shares will probably beat their progress counterparts.

The development is already beneath approach. Contemplate:

* The Vanguard S&P 500 Development Index change traded fund VOOG,

* Worth teams together with banks and vitality shares are crushing progress shares like Ark Make investments’s favourite names. The KBW Financial institution Index BKX,

Right here’s a have a look at 4 forces favoring worth over progress, adopted by 14 worth shares to think about, courtesy of two worth investing specialists.

1. Rising rates of interest favor worth shares

A whole lot of traders worth shares utilizing the web current worth (NPV) mannequin — particularly high-growth shares which have anticipated earnings within the distant future. This implies they low cost projected earnings again to the current utilizing a reduction price, usually the yield on 10-year Treasuries TMUBMUSD10Y,

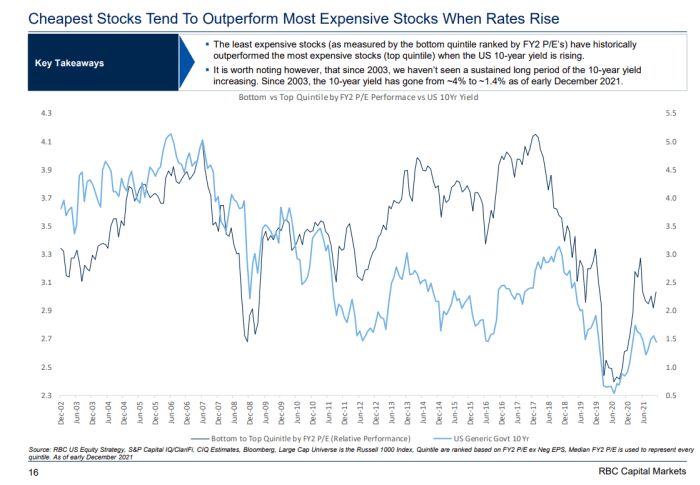

So naturally, when 10-year yields rise as they’re now, costly shares in areas like tech underperform the most affordable shares in areas like cyclicals, financials and vitality, factors RBC Capital Markets strategist Lori Calvasina.

Likewise, price-to-earnings (P/E) multiples of the costliest shares change into inversely correlated with 10-year yields throughout Federal Reserve mountaineering cycles, she factors out. The reverse is true for worth shares.

“The least costly shares have traditionally outperformed the costliest shares when the 10-year yield is rising,” she says.

Ed Yardeni at Yardeni Analysis initiatives the 10-year yield might rise to 2.5% by yearend, from round 1.79% now. If he’s proper, that means worth outperformance will proceed. Although there can be counter-rallies in progress and tech alongside the best way (extra on this beneath).

Right here’s a chart from RBC Capital Markets displaying that worth traditionally outperforms as yields rise. The sunshine blue line represents bond yields, and the darkish blue line represents low-cost inventory efficiency relative to costly shares.

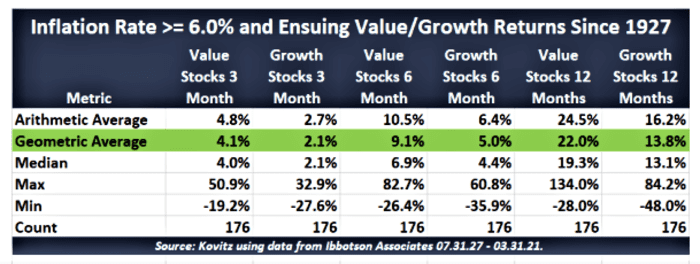

2. Larger inflation is optimistic for worth methods

This has traditionally been the case, factors out John Buckingham, a worth supervisor at Kovitz Funding Group who pens The Prudent Speculator inventory letter. He expects a repeat now. A part of the reason being that inflation fears drive up the yield on 10-year bonds, creating the detrimental NPV impact for progress names (described above).

Inflation accelerated on the quickest tempo in December since 1982, the federal government reported Wednesday. It was the third straight month by which inflation measured yearly exceeded 6%.

However one other issue is at work. Throughout inflationary instances, firms with precise earnings can enhance revenue margins by elevating costs. As a gaggle, worth firms are typically extra mature, which implies they’ve earnings and margins to enhance. Traders discover this, in order that they’re interested in these firms.

In distinction, progress names are characterised by anticipated earnings, in order that they profit much less from worth hikes.

“Development firms don’t make cash to allow them to’t enhance margins,” says Buckingham. “They’re paying staff extra, however they don’t seem to be making extra money.”

Right here’s a chart from Buckingham displaying that worth shares traditionally outperform when inflation is excessive.

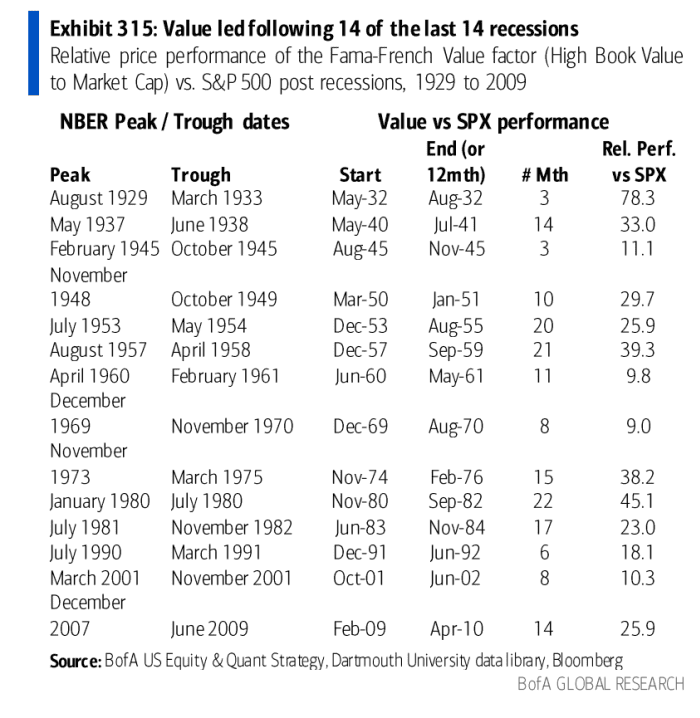

3. Worth shares do effectively after recessions

Traditionally, this has been the case, as you possibly can see within the chart, beneath, from Financial institution of America. That is probably as a result of inflation and rates of interest are likely to rise throughout financial rebounds. Each developments are a detrimental for progress shares relative to worth, for the explanations outlined above.

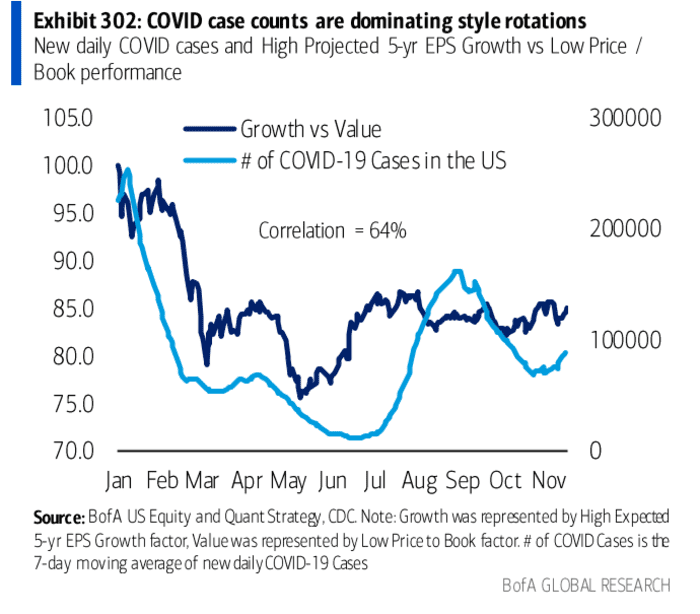

4. Worth shares do higher when Covid instances decline

This has been the case all through the pandemic, as you possibly can see within the graphic beneath from Financial institution of America. That is in all probability as a result of when Covid instances decline, the prospects for the financial system enhance, which suggests inflation and rates of interest will rise — each of which make progress lag worth, traditionally. Omicron is spreading so quick, the case rely is prone to peak by the tip of January. So this impact might kick in quickly.

Within the chart beneath, the light-blue line is the Covid case rely. The dark-blue line is the relative outperformance of progress to worth. When the dark-blue line declines, it means worth shares are doing higher than progress shares.

Which shares to favor

Cyclical names, banks, insurance coverage firms and vitality companies populate the worth camp. So these are the teams to think about.

Buckingham suggests these 12 names, most of that are within the sectors above: Citigroup C,

Bruce Kaser of the Cabot Turnaround Letter counts Credit score Suisse CS,

“Idea shares get approach over bid, and that’s when worth does the perfect,” he says.

Whereas idea shares founder, worth firms proceed to grind it out and submit precise earnings, so cash migrates to them. That is what occurred for a very long time, after the tech bubble burst years in the past.

“After 2000, worth outperformed for a decade,” he says.

Count on countertrends

Little question, there can be countertrend reversals alongside the best way.

“These rotations are likely to wind down as each side of the rotation get overplayed,” says Artwork Hogan, the chief strategist at Nationwide Securities.

Right here’s an element that may quickly cool the rotation, close to time period. Traders are about to study that first-quarter progress is taking a success as a result of Omicron quarantines are hurting firms. This information on financial progress might cut back the fears about inflation and rising rates of interest sparking the migration to worth.

However Omicron is so contagious, it’s going to in all probability go as quick because it got here. That’s what we see in nations struck early on, like South Africa and Britain. Then components like stimulus, a listing construct, and robust client and company steadiness sheets will revive progress.

This could imply the growth-value dichotomy will proceed this yr — since three of the 4 important forces driving the development are linked to robust progress.

Michael Brush is a columnist for MarketWatch. On the time of publication, he owned TSLA. Brush has advised TSLA, C, FDX and GM in his inventory publication, Brush Up on Stocks. Observe him on Twitter @mbrushstocks.

Source: MarketWatch.com