WHAT HAPPENED: Federal Reserve Chairman Jerome Powell signaled possible interest rate cuts amid ongoing economic uncertainty during his speech at the Fed’s annual Jackson Hole conference.

WHAT HAPPENED: Federal Reserve Chairman Jerome Powell signaled possible interest rate cuts amid ongoing economic uncertainty during his speech at the Fed’s annual Jackson Hole conference.

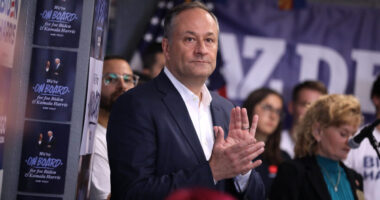

WHO WAS INVOLVED: Jerome Powell, Federal Open Market Committee (FOMC) members, and President Donald J. Trump, who has been vocal about his desire for lower rates.

WHO WAS INVOLVED: Jerome Powell, Federal Open Market Committee (FOMC) members, and President Donald J. Trump, who has been vocal about his desire for lower rates.

WHEN & WHERE: Friday, August 22, 2025, at the Federal Reserve’s annual conference in Jackson Hole, Wyoming, with a potential interest rate cut being enacted in September.

WHEN & WHERE: Friday, August 22, 2025, at the Federal Reserve’s annual conference in Jackson Hole, Wyoming, with a potential interest rate cut being enacted in September.

KEY QUOTE: “[W]ith policy in restrictive territory, the baseline outlook and the shifting balance of risks may warrant adjusting our policy stance.” — Jerome Powell

KEY QUOTE: “[W]ith policy in restrictive territory, the baseline outlook and the shifting balance of risks may warrant adjusting our policy stance.” — Jerome Powell

IMPACT: Powell’s remarks caused stocks to surge, with the Dow Jones Industrial Average climbing over 600 points, while Treasury yields dropped significantly. Moreover, the Jackson Hole speech appears to tee up an interest rate cut at September’s Federal Open Market Committee (FOMC) meeting.

IMPACT: Powell’s remarks caused stocks to surge, with the Dow Jones Industrial Average climbing over 600 points, while Treasury yields dropped significantly. Moreover, the Jackson Hole speech appears to tee up an interest rate cut at September’s Federal Open Market Committee (FOMC) meeting.

Federal Reserve Chairman Jerome Powell addressed potential interest rate cuts during his speech at the central bank’s annual Jackson Hole conference on Friday. He cited “sweeping changes” in tax, trade, and immigration policies as factors creating uncertainty for policymakers. Powell noted that while the labor market ostensibly remains strong, data suggest employment could be weakening and this may necessitate a change in the Fed’s interest rate policy.

“[W]ith policy in restrictive territory, the baseline outlook and the shifting balance of risks may warrant adjusting our policy stance,” Powell said. Although he stopped short of explicitly endorsing a rate cut, Wall Street interpreted his comments as a sign of potential easing. The Dow Jones Industrial Average gained over 600 points following the speech, and the two-year Treasury note yield dropped by 0.08 percentage points.

Powell emphasized the independence of the Federal Reserve from elected officials, stating, “FOMC members will make these decisions, based solely on their assessment of the data and its implications for the economic outlook and the balance of risks. We will never deviate from that approach.” This comes amidst pressure from President Donald J. Trump, who has repeatedly called for aggressive rate cuts.

The Fed has maintained its benchmark borrowing rate between 4.25 percent and 4.5 percent since December, citing uncertainty over the long-term impact of tariffs on inflation. Powell expressed that while tariff impacts may be “short-lived,” current economic conditions allow the Fed to proceed cautiously.

Importantly, the Fed chairman finally acknowledged that the central bank’s current rate policy could be hampering employment. “This slowdown is much larger than assessed just a month ago, as the earlier figures for May and June were revised down substantially,” Powell said, with the caveat: “But it does not appear that the slowdown in job growth has opened up a large margin of slack in the labor market—an outcome we want to avoid.”

Join Pulse+ to comment below, and receive exclusive e-mail analyses.

The post Is Jerome Powell Finally Poised to Cut Interest Rates? appeared first on The National Pulse.