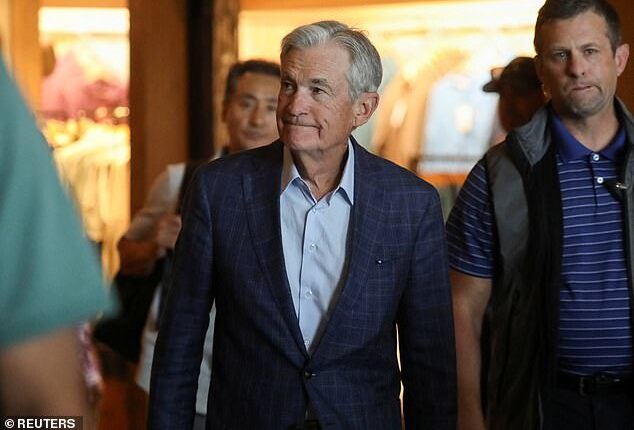

Jerome Powell suggested an interest rate cut is imminent – sending stocks soaring.

Powell expressed concerns over the jobs market and wider economy at the annual summit in Jackson Hole, Wyoming.

The chair of the Federal Reserve told central bankers and economic power-players that he was concerned that GDP had slowed and the unemployment rate was rising.

The S&P 500 surged 1.4 percent on Powell’s remarks while the tech-heavy Nasdaq rose 1.7 percent.

Wall Street is hoping that Powell and the rest of the Fed’s Open Market Committee will vote for a quarter point cut at the next meeting in September.

‘The balance of risks appears to be shifting,’ Powell told the Jackson Hole Economic Policy Symposium.

The ‘risks to inflation are tilted to the upside, and risks to employment to the downside’ may ‘warrant adjusting our policy stance’ Powell said.

‘Jerome Powell’s speech in Jackson Hole paves the way for a September rate cut,’ Paul Stanley, chief investment officer, Granite Bay Wealth Management said.

Jerome Powell suggested an interest rate cut is imminent

‘Investors have been worried in recent months about the sudden and sharp slowdown in hiring, and lower rates would help to ease financial conditions and potentially give employers more confidence to expand and hire,’ Stanley explained.

The Fed sets benchmark interest rates – currently between 4.25 and 4.5 percent -that influence everything from mortgage costs to stock prices.

Markets respond not just to official Fed decisions, but also to hints about future moves.

A grim July jobs report prompted many on Wall Street to bet on a rate cut in September.

Nonfarm payrolls added 73,000 in July, far lower than the 100,000 expected by analysts. The unemployment rate also ticked up to 4.2 percent.

The report also sharply revised down the figures for May and June by a combined 258,000 jobs from the previously released figures.

For months Trump has pressured Powell to cut rates, threatened to fire him, appoint a shadow chair and even harangued him over the cost of improvements to the Fed’s offices.

The independence of the Fed is seen by Wall Street as vital for market stability. Firing Powell would likely cause a rout in financial markets.