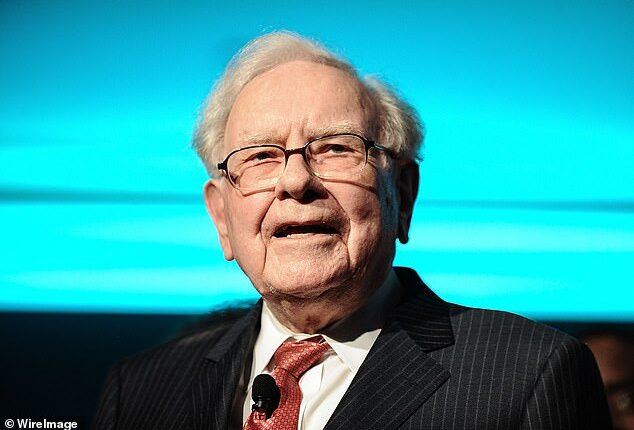

Famed investor Warren Buffett has snapped up millions of shares in a company that Wall Street has run away from.

Berkshire Hathaway has quietly built a stake in insurer UnitedHealth over the past two quarters.

So far, they’ve accumulated 5 million shares in the company, a regulatory filing showed on Thursday.

Buffett, the investor known as the ‘Oracle of Omaha,’ has a decade-long track record of buying stocks during their dip and riding companies back to profits.

UnitedHealth is another example. The company has been on a 46 percent slide since January.

At the beginning of the year, UnitedHealth was trading at over $504. The stock closed today at just over $271.

The news of Buffett’s investment gave the company a quick reprieve: UnitedHealth’s share price jumped ten percent in extended trading.

For years, the insurer was once seen as a dominant stock. Constant profit gains, a reputation for competent management, and all-important insurance contracts gave the stock a halo.

Warren Buffett scooped up 5 million shares of UnitedHealth, regulatory filings show

But the bubble has burst over the past year.

UnitedHealth has been at the center of several major headline-generating controversies: the company is facing federal government inquiries over its Medicare pricing and has missed financial expectations.

In December, its CEO, Brian Thompson, was shot and killed in Manhattan.

Stephen Hemsley, the CEO who led the company with a tight ship from 2006 through 2017, has returned to the position.

This isn’t the first time Buffett owned the company’s stock. From 2006 to 2009, he kept 1.18 million shares of the healthcare company in his portfolio.

He sold the stake in 2010 amid a broader retreat from the health insurance industry.

Buffett’s investments typically lead to major investment inflows into once-struggling companies.

The 94-year-old investor’s conglomerate owns dozens of companies, including insurer Geico, battery maker Duracell, and restaurant chain Dairy Queen.

UnitedHealth is facing a wave of negative headlines – including federal investigations into its pricing

In December, Buffett restarted spending after pulling much of his cash from the market.

He bought a tranche of stocks worth $563 million in struggling companies, like Occidental Petroleum and VeriSign.

In February, Berkshire Hathaway purchased $54 million worth of shares in Sirius XM.

A day after the announcement, the company’s stock popped 12 percent.

His decision to sell stock also has a negative impact on the stock market.

In February, filings showed he sold shares of DaVita, a healthcare company.

The stock immediately dipped more than 11 percent.