Published: March 6, 2025 at 6:30 a.m. ET A favorite aphorism of the…

Browsing Tag

Transportation/Logistics

84 posts

Trump hates the Biden-era Chips Act. What’s next for semiconductor makers?

Published: March 5, 2025 at 3:59 p.m. ET President Trump made no bones…

Wall Street’s biggest bear says the S&P 500 could drop to 4,200. Here’s his advice for right now.

Published: March 5, 2025 at 6:37 a.m. ET Heading into 2025, most Wall…

What 125 years of data says about diversification and investing at record highs

Global investment returns yearbook finds stock-market investing is profitable but volatile.

10 dividend stocks for investors who also want growth

These companies have attractive dividend yields, and analysts expect them to show…

DHL owner forecasts no recovery this year after 25% decline in full-year profits

Shares in DHL owner Deutsche Post fell on Wednesday after the German…

How Morgan Stanley’s bearish strategist may be right for the wrong reason

Surely everyone’s contrarian impulses were triggered by the sight of the guy…

JetBlue, Spirit Airlines terminate 2022 merger agreement

JetBlue Airways Corp. and Spirit Airlines Inc. said Monday they have reached…

Opinion: U.S.-China tensions over Taiwan threaten to derail Nvidia and other tech giants

The concentration of advanced semiconductor manufacturing in Taiwan has raised fears in…

U.K. pension funds to disclose domestic investment as U.K. stock market falters

Chancellor Jeremy Hunt on Saturday said U.K. pensions will have to disclose…

Opinion: Most AI, software and semiconductor stocks are a crowded trade right now

“Don’t fall into the trap of thinking that every tech company which…

Air France-KLM sinks to fourth quarter loss, IAG posts record profit

Shares in two of Europe’s top flag carriers took opposite trajectories on…

Virgin Galactic narrows losses, but the space-tourism stock drops

Virgin Galactic Holdings Inc. lost less money than expected in the latest…

Boeing’s delays could see Ryanair hike prices by 10%, says CEO O’Leary: report

Mounting problems at plane manufacturer Boeing could see Ryanair forced to cut…

Should stock-market investors stop worrying about the Fed and just keep loving AI?

It might seem at times that investors care more about Jensen Huang…

Buffett praises ‘architect’ Munger, but doesn’t reveal new investment for 2024

Berkshire Hathaway Chairman Warren Buffett began his annual missive to investors on…

Opinion: Nvidia’s growth and Intel’s chip-making plans depend on AI fulfilling its promise

“AI demand isn’t slowing; it isn’t stopping, and those who claim this…

Nvidia may shine again when it reports on Wednesday

Nvidia NVDA, -0.06% will announce quarterly results next week, and once again…

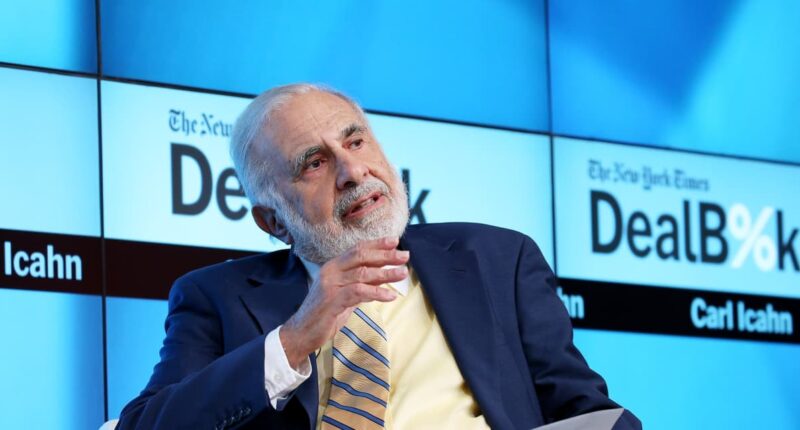

Carl Icahn lands two JetBlue board seats days after disclosing stake in airline

Just four days after Carl Icahn disclosed a 9.9% stake in JetBlue…

As U.S. lander heads to moon, Apollo 17 astronaut eyes future space exploration

Intuitive Machines Inc.’s historic attempt to place the first U.S. commercial lander…

JetBlue stock rallies after Carl Icahn takes nearly 10% stake in airline

Shares of JetBlue Airways Corp. rose sharply after hours on Monday after…